Only a handful of factors make modern coins worth more than face value:

Almost all coins dated after 1948 do not qualify for any of these factors. A few coins, however, qualify, and the value of such coins may increase over the course of a lifetime. Here's how to tell if a modern coin is valuable or may become valuable soon.

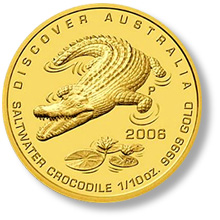

Bullion - No circulating coins today are made of gold or silver. All nations went off the gold standard before or during the 1960s. Some pre-1960 coins are made of silver, and many modern proofs and commemorative coins (made exclusively for collectors) contain precious metal. If your coin is made of gold, silver, platinum, or palladium, it is worth at least the value of its precious metal. Many modern precious metal coins say so explicitly. Look for legends such as 0.9999 fine silver or 1/2 ounce pure gold. If you have a precious metal coin, go to kitco.com (or a similar web site) to find the current value of the precious metal. Check often. The price of precious metals changes every day. When dealing with precious metal, ounces and troy ounces are the same thing; the troy is understood. A troy ounce is not the same as a 'normal' avoirdupois ounce. Be careful.

Bullion - No circulating coins today are made of gold or silver. All nations went off the gold standard before or during the 1960s. Some pre-1960 coins are made of silver, and many modern proofs and commemorative coins (made exclusively for collectors) contain precious metal. If your coin is made of gold, silver, platinum, or palladium, it is worth at least the value of its precious metal. Many modern precious metal coins say so explicitly. Look for legends such as 0.9999 fine silver or 1/2 ounce pure gold. If you have a precious metal coin, go to kitco.com (or a similar web site) to find the current value of the precious metal. Check often. The price of precious metals changes every day. When dealing with precious metal, ounces and troy ounces are the same thing; the troy is understood. A troy ounce is not the same as a 'normal' avoirdupois ounce. Be careful.

Coins that look precious - If your post-1948 coin looks precious, but does not contain an inscription such a 0.9999 fine silver, it is probably made of common metal. For example, the new US 'gold' dollar coins are made of manganese-brass. Take your coin to a jeweler to have it tested.

Use the jeweler test for silvery coins dated before the mid-1960s or for any post-1948 coin that looks super-good (it may be a silver proof). During the 1960s most countries changed their silver coinage to non-precious metal. In the US, for example, dimes and quarters dated before 1965 are made of 90 percent silver and are very valuable today. Dimes and quarters dated after 1964 are made of (valueless) copper-nickel.

What about bullion investing? We have a somewhat lengthy discussion of buying gold and silver coins as investments at this CoinQuest link. Remember, however, that we are just coin collectors, not investment advisors!

Eye Appeal - Coin collectors are a finicky bunch. They spend hours pouring over mounds of coins and, when they see one they like, they buy it for their collection. Eye appeal is the term collectors use to describe variations in attractiveness that occur naturally in all coins. A few coins stand out, most don't. Even if a coin, modern or otherwise, has no other redeeming quality, coins with strong eye appeal are worth money. Usually this is only a few US dollars, but for a coin otherwise worth face value, that is a lot.

Eye Appeal - Coin collectors are a finicky bunch. They spend hours pouring over mounds of coins and, when they see one they like, they buy it for their collection. Eye appeal is the term collectors use to describe variations in attractiveness that occur naturally in all coins. A few coins stand out, most don't. Even if a coin, modern or otherwise, has no other redeeming quality, coins with strong eye appeal are worth money. Usually this is only a few US dollars, but for a coin otherwise worth face value, that is a lot.

Fully uncirculated coins often have strong eye appeal. Sometimes certain circulated coins stand out above all others, and they, too, carry premium values due to eye appeal. The olympic coin above has great eye appeal, even though it is in circulated condition.

Collectibility (Modern Commemoratives) - Minting technology has progressed to the point where modern coins can be made artistically beautiful. Some are absolutely exquisite. Modern commemorative coins, minted especially for collectors often in breathtaking proof display, make wonderful collectibles. Modern commemoratives should be purchased as gifts, artwork, or for their intrinsic beauty and appeal, but not for collector value, for investment, or for the sake of the grandchildren with the hope 'this will be valuable someday.' In all likelihood, modern commemoratives will not rise in value.

Collectibility (Modern Commemoratives) - Minting technology has progressed to the point where modern coins can be made artistically beautiful. Some are absolutely exquisite. Modern commemorative coins, minted especially for collectors often in breathtaking proof display, make wonderful collectibles. Modern commemoratives should be purchased as gifts, artwork, or for their intrinsic beauty and appeal, but not for collector value, for investment, or for the sake of the grandchildren with the hope 'this will be valuable someday.' In all likelihood, modern commemoratives will not rise in value.

Modern gold or silver commemoratives are worth their weight in bullion, nothing more. Do not be fooled by Certificates of Authenticity, fancy packaging, and other marketing hype.

Governments of (just about) all countries in the world have figured out that people are willing to pay dearly for commemorative coins. So governments issue them and sell them at very high prices. Immediately upon purchase, their value plummets to the bullion value or to one-quarter to one-half of the retail price. This is how much a dealer would normally pay to buy the coin back from you. Commemorative hype is practised extensively in the US, Canada, and Europe, but it is certainly not limited to these countries. Sometimes governments limit supply of modern commemoratives to force price upward.

Die Varieties and Minting Errors. - It usually takes a strong magnifier to discern small variations in coins with die varieties. Minting errors, on the other hand, jump out and sock you in the eye. There is a small but energetic following of both types of abnormalities, so both types carry collector premiums over and above the normal coin value.

Die Varieties and Minting Errors. - It usually takes a strong magnifier to discern small variations in coins with die varieties. Minting errors, on the other hand, jump out and sock you in the eye. There is a small but energetic following of both types of abnormalities, so both types carry collector premiums over and above the normal coin value.

If you look very closely at the 1969S Lincoln cent, you may be able to discern doubling in the date and legends. This is a verified minting error and there are still 1969S 'doubled die obverse' coins in circulation today.

To be valuable, die varieties and minting errors must be imparted to coins before they leave the mint. Abnormalities derived outside the mint are not valuable. What most people see as varieties and errors are not that at all, but damage done to the coin in circulation. Nevertheless, varieties and errors can add tremendous value to some coins, even hundreds of US dollars. Each coin must be handled on a case-by-case basis.

Mintage Rarity - Ultimately the rarity of a coin makes it valuable. If a coin is easily available it has no value past the factors discussed above. But if it is hard to find, rarity can add significant value, even to coins dated after 1948.

Mintage Rarity - Ultimately the rarity of a coin makes it valuable. If a coin is easily available it has no value past the factors discussed above. But if it is hard to find, rarity can add significant value, even to coins dated after 1948.

The coin to the right is an American Silver Eagle bullion coin. These have been minted since 1986 and are a favorite with collectors worldwide. The 1996 date is the one with the lowest mintage (3.6M coins) and therefore carries a premium value.

Astute collectors know the mintage of these coins is low compared to others like them. Speculation about future values drives up current values.

Astute collectors know the mintage of these coins is low compared to others like them. Speculation about future values drives up current values.

Mintage figures are available in most coin catalogs. (We do not track mintage on CoinQuest.) In 1969, The Netherlands minted a 5 cent coin with two different privy marks: a cock and a fish. The 1969 Netherlands 5 cent with the fish has the lowest mintage of the entire series, only 5 million. In a hundred years, this coin will probably be worth a lot more than one from 1975, which has a mintage of 46 million. However, the truth is that currently both dates are worth very little.

Another interesting example is the 1959 10 ore from Denmark, which is quite famous among Danish coin collectors. The series with this design ran from 1956 through 1960. Denmark is not the most populous country, and all the 10 ore coins in this series had a mintage of over 5 million, enough to go around for everyone. The 1959 coin is an exception, with just 1.25 million minted. The 1959 coin quickly became scarce. Speculators started depleting the markets, and today these coins sell over $20+ US dollars, even in worn condition.

If you are interested in mintage rarity, you must invest in coin catalogs. Catalogs easily contain over 1000 times the information available on CoinQuest, and they include mintage figures for each date and mint mark. Find the lowest mintages and then look for uncirculated examples. Those will probably increase in value over time.

Grade Rarity - The minting of modern coins is almost a science in itself, and by careful polishing of the coin dies, striking the coin multiple times, and very careful handling and storage, proof coins can be made exquisitely beautiful. Sometimes, when coins are struck for normal business situation, the planets metaphorically align and an unusually nice coin is produced. If the coin die is fresh, the planchet (the blank coin) is free of blemishes, and the coin is fortunate enough to escape rough handling, it can almost resemble a proof coin when found in a coin roll.

Grade Rarity - The minting of modern coins is almost a science in itself, and by careful polishing of the coin dies, striking the coin multiple times, and very careful handling and storage, proof coins can be made exquisitely beautiful. Sometimes, when coins are struck for normal business situation, the planets metaphorically align and an unusually nice coin is produced. If the coin die is fresh, the planchet (the blank coin) is free of blemishes, and the coin is fortunate enough to escape rough handling, it can almost resemble a proof coin when found in a coin roll.

This American Silver Eagle is a common coin made of silver bullion. As such, it would normally sell for a few dozen US dollars. Slabbed and declared to be high-grade MS-70, it can (and did) sell for over $30000!

This American Silver Eagle is a common coin made of silver bullion. As such, it would normally sell for a few dozen US dollars. Slabbed and declared to be high-grade MS-70, it can (and did) sell for over $30000!

Slab speculators A small subset of collectors specialize in finding the most beautiful of coin specimens and sending them for professional grading by companies such as PCGS, ICG, ANACS, or NGC. These companies assign a numerical grade to the coin. The exact intricacies of this grading system are complicated, but what you need to know is that it goes from 1 to 70 where 70 is a 'perfect' coin, and that the grading standards are a lot tougher from 69 to 70 than from, say, 61 to 62.

With this in mind, look at the slabbed coin sold at auction on GreatCollections.com. This is an American Silver Eagle, a modern bullion coin minted by the US government. It contains one troy ounce of silver, currently worth about $24 US dollars, yet the sale price of the auction is over thirty thousand dollars. Fourteen different people bid to win this coin, making a total of 55 bids.

Why did they pay over a thousand times the silver value of the coin? The answer is simple: that coin is the only one of its kind graded as MS-70 by PCGS. It is the only 'perfect coin' according to the experts. Now, does this excuse the high sales price? I have heard people say that they sometimes buy the holder, not the coin. I could certainly see how that could be applied in this case. Without the holder, that coin would be worth $24 dollars. In the holder, it is worth over $30,000.

About CoinQuest | Privacy Policy | Contact CoinQuest

Copyright 2009 to 2024 CoinQuest.com, all rights reserved.

Daily visitors 230, minutes per visit 6.5, daily coin views 562